A management tactic to intimidate the MNA bargaining team at Owatonna Hospital backfired during recent contract negotiations. Instead of backing down after all four members simultaneously received disciplinary coaching on the solicitation policy for distributing materials, the bargaining team grew more determined to win a fair contract.

A management tactic to intimidate the MNA bargaining team at Owatonna Hospital backfired during recent contract negotiations. Instead of backing down after all four members simultaneously received disciplinary coaching on the solicitation policy for distributing materials, the bargaining team grew more determined to win a fair contract.

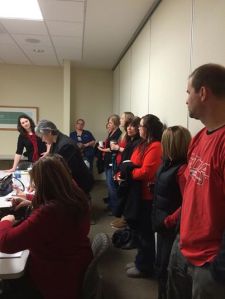

Their attitude was fortified by enthusiastic support from their 150 colleagues. A crowd of nurses turned out at a Nov. 18 action prior to a bargaining session to demonstrate the confidence in their team. The group also conveyed its resolve to hold hospital management accountable for a promise it made seven years ago that wages and benefits for Owatonna nurses would match metro compensation.

On Wed., Dec. 18 that resolve produced results as nurses ratified an agreement with a 5.5 percent wage increase over three years; a significant increase in on-call pay; tuition reimbursement enhancements and implementation of preceptor pay. The nurse turnout for the vote was the largest in years.

Monthly Archives: December 2013

Travelers and Recruiters of the Year Announced for 2013

Healthcare Traveler magazine has announced the winners for its annual listing of Travelers and Recruiters of the Year. The publication recognizes outstanding recruiters in the field of healthcare travel as well as outstanding Travelers — including quite a few Travel Nurses!

For 2013, 48 Travelers were chosen as winners. According to the magazine, these individuals exhibit great characteristics for healthcare Travelers such as “flexibility, dependability, loyalty, professionalism, and an adventurous spirit … especially when an assignment isn’t ideal, or workplace circumstances call for a level head.” As any Travel Nurse knows, adaptability is crucial when traveling.

Winning Travelers were majority RNs, but also represented quite a few Allied Health Professionals, among others. Some Travelers are fairly new to the game and giving standout performances right out of the gate, such as Medical Solutions Travelers Quinn Anthony and Marla Preader who each have one year traveling. Quite a few winning Travelers have been at for 2-10 years. Then there are the real vets, such as Labor and Delivery RN Patricia Pitts with CRU48 who has 22 years of travel under her belt.

Winning Travelers were majority RNs, but also represented quite a few Allied Health Professionals, among others. Some Travelers are fairly new to the game and giving standout performances right out of the gate, such as Medical Solutions Travelers Quinn Anthony and Marla Preader who each have one year traveling. Quite a few winning Travelers have been at for 2-10 years. Then there are the real vets, such as Labor and Delivery RN Patricia Pitts with CRU48 who has 22 years of travel under her belt.

No matter how long they’ve been on the road, a big congrats to all of the 2013 Travelers of the Year! See the full list here.

As for the Recruiters of the Year, these are individuals who foster close, trusting relationships with their Travelers; working to understand and cater to the Travelers’ personal needs along with his or her career goals. Healthcare Traveler says that some great qualities of a recruiter are “willingness to listen, the capacity to empathize, and the desire to help when things get sticky.”

The magazine chose 51 recruiters from across many agencies as their 2013 Recruiters of the Year. As any Travel Nurse knows, a good Recruiter relationship is absolutely essential to success in the industry. The folks on this list are legit and might be a good place to start if you’re looking for a recruiter you click with. Click here for the full list of 2013 Recruiters of the Year.

Have you or your recruiter ever been recognized in this annual best of honor? Share with us in the comments if so!

Travel Nurse: Christmas Activities and Events

As a travel nurse, finding out what the local Christmas Traditions and activities are can be time consuming. We’ve gathered a few interesting sites and activities to give you some ideas on how to spend your Travel Nurse Christmas! The Round-Up Researched and provided to you by: Teresa Posthumus A blogger’s Top 10 Christmas Celebrations in America. Check out some of the events- great parade ideas whether you are in Idaho, Washington, Minnesota or Arkansas see what is happening in your neighborhood. The Top 10 U.S. Christmas Celebrations Parades, Parades, Parades. What is happening in your area? Great Christmas Parades from Riverside, California , Coeur d’Alene, Idaho, North Pole, Alaska or numerous other places. Listed in this website are many great parades that are happening around the USA. Go see something new. America’s best places for holiday lights Looking for something different and unusual to do for the Christmas Season? Check out this website and see what you can come up with. From exploring towns named “Santa Clause” or a Santa Clause Pub Crawl in Reno, NV. Something for everyone. Are you in one of these 10 great places to put a spin on the Christmas spirit? From the well known ‘Macy’s Parade’ and Times Square Christmas to the lesser known “Christmastown” in North Carolina. Check out these Best Christmas Celebrations in America How about something different this year? Catch a Christmas Boat Parade in Portland, OR, Charleston, SC, Tempe, Az or also at many other locations. Make sure you dress warm for the […]

The post Travel Nurse: Christmas Activities and Events appeared first on The Gypsy Nurse.

We Need A “Robin Hood” Tax On Wall Street

Jim Hightower (Photo by Larry D. Moore)

The congressional Republicans are still whining loudly that the federal government cannot pay its debts, and therefore the programs to help hurting Americans must be cut. What they will not tell you is that it is their own policy that has caused the huge budget deficit — a policy of waging unfunded wars while cutting taxes for the rich and giving unneeded subsidies to large corporations, and perhaps most egregious of all, giving Wall Street a “free ride” when it comes to taxation.

The truth is that the United States is still the richest country in the world, and there is plenty of money in this country to fund programs to help ordinary Americans that are hurting. I have spoken many times on this blog about my belief that the rich should pay a little more (by taxing their capital gains income as earned income), and the corporations should pay their fair share (by removing the billions in unneeded subsidies and loopholes).

But there is another thing that can, and should, be done — and that is to institute a “Robin Hood” tax on Wall Street transactions. This would be a tiny tax on all stocks bought through the stock market. The tax would be small enough to not inhibit any stock trading, but because of the huge volume of trades, would be enough to add hundreds of billions of dollars in federal government revenue.

One of the best explanations of why this tax would be a good thing for this country is put forward by Jim Hightower (a leading Texas progressive). Here is some of what he has to say on the subject at his website, the Hightower Lowdown:

When I buy a $3 pack of toilet paper here in Austin, Texas, I pay an extra 8.25 percent in sales tax. If I buy a cuppa jo, book, bicycle, or blue jeans–same thing.

But if a high-roller in the HFT game buys $10 million worth of corporate stock, $10 million worth of oil futures, and $10 million worth of a Goldman Sachs package of derivatives–he or she pays zero tax on the sales.

First, it’s a rank injustice that even the poorest among us are taxed on their purchases while millionaire Wall Streeters who make high-speed computerized purchases skate through this gaping loophole. Second, the profiteering churners and reckless speculators wrecked the country’s economy, and they’ve never paid for the mess they made for so many millions of families that consequently lost jobs, homes, income, and hope.Third, this is a BIG idea that will let our society do big things again. Plugging this loophole with even a small sales tax on purchases by high frequency traders will generate the money America needs to do what needs to be done.

A Financial Transaction Tax. An FTT is not an idea whose time has come, but simply returned. From 1914 to 1966, our country taxed all sales and transfers of stock. The tax was doubled in the last year of Herbert Hoover’s presidency to help us recover from the Great Depression. Today, 40 countries have FTTs, including the seven with the fastest-growing stock exchanges in the world. Seven members of the European Union (including Germany and France) voted for a financial transaction tax to help blunt rising poverty, restore services, and put people back to work.

This is no soak-the-rich-idea. Rather than asking the Wall Street crowd to join us in paying a six to 12 percent sales tax, the major FTT proposal gaining support in the US calls for a 0.5 percent assessment on stock transactions. That’s 50 cents on a $100 stock buy, versus the $8.25 I would pay for a hundred-dollar bicycle.

Even at this miniscule rate, the huge volume of high speed trades means an FTT would net about $300-350 billion a year for our public treasury. Plus, it’s a very progressive tax. Half of our country’s stock is owned by the 1 percenters, and only a small number of them are in the HFT game. Ordinary folks who have small stakes in the markets, including those in mutual and pension funds, are called “buy-and-hold” investors–they only do trades every few months or years, not daily or hourly or even by the second, and they’ll not be harmed. Rather it’s the computerized churners of frothy speculation who will pony up the bulk of revenue from such a transaction tax.

An FTT is a straightforward, uncomplicated way for us to get a substantial chunk of our money back from high finance thieves, and we should make a concerted effort to put the idea on the front burner in 2014 and turn up the heat. Not only do its benefits merit the fight, but the fight itself would be politically popular. One clue to its political potential is that the mere mention of FTT to a Wall Street banker will evoke a shriek so shrill that the Mars rover hears it. That’s because they know that this proposal would make them defend the indefensible: Themselves.

First, the sheer scope of Wall Street’s self-serving casino business model would be exposed for all to see. Second, they would have to admit that they’re increasingly dependent on (and, therefore, making our economy dependent on) the stark-raving insanity of robotic high frequency speculation. Third, it’ll be completely ridiculous for them to argue that protecting the multi-trillion-dollar bets of rich market gamblers from this tax is more important than meeting our people’s growing backlog of real needs.

Unsurprisingly, then, Koch-funded operatives and other defenders of privilege are rushing out articles that amount to Wall Street blah-blah-blah: “FTT would hurt poor pensioners, farmers, long-term investors, job creation, liquidity… and blah, blah, blah.” Note that there’s nary a mention of who’ll really be pinged: Wall Street’s gamblers and thieves. After all, to concede that they’ll be hurt, even a little, would elicit a coast-to-coast shout of, “Yes!”

The Financial Transaction Tax idea is blessed with broad support, ranging from Bill Gates to Occupy Wall Street to the Vatican, and it’s been embraced by dozens of major economists, including Nobel laureates Joseph Stiglitz and Paul Krugman. But this fight will be won at the ground level of good politics, and that’s well underway. Many grassroots groups and several progressives in Congress have already forged solid coalitions and are going to the country-side with a growing campaign to make Wall Street pay.

A major push is being made under the banner of the “Robin Hood Tax,” led by National Nurses United, National People’s Action, Health GAP, andProgressive Democrats of America. They and some 150 other organizations are backing the IPA. (This IPA is not a beer, though I suggest the organizers brew one to help popularize, cheer, and lubricate the cause.) It’s theInclusive Prosperity Act, a proposal by Rep. Keith Ellison and others for an FTT. Sen. Tom Harkin and Rep. Peter DeFazio have another version with a more modest tax rate.

This campaign offers a remarkable democratic opening. It widens America’s public policy debate from the plutocrats’ tired, narrow-minded mantra of defeat: “We’re broke. Big undertakings are beyond us. Shrink all expectations for yourselves, your children, and your country’s future.” Instead, a new conversation can begin, saying: “Look under that rock. There’s the money we need to invest in people. Let’s get America moving again!”

A sales tax on speculators can deliver tangibles that people need but Wall Street says we can’t afford–infrastructure, Social Security, education, good jobs, etc. Just as important, it can deliver intangibles that our nation needs but Wall Street tries to ignore–fairness, social cohesion, equal opportunity, etc. It’s a holiday gift card for America’s future–a gift that literally would keep on giving.

Holiday Greetings

The President, Board of Directors and Staff of the Pennsylvania State Nurses Association wish you a bright and delightful holiday season! We look forward to serving nurses in 2014! Click here to see our digital year-in-review.

Effectively Lead Others in Changing Environments through Holistic Leadership Models

Talking Travel Nurse Taxes: Should I (ever) File Tax Exempt?

There are patients that we dread to care for. During report, we tactfully offer to take more patients, a more critical patient, or even offer to float to another area to avoid being assigned to the ONE patient no one wants. In the tax world, one conversation tax professionals dread is with a taxpayer that filed exempt and owes a bundle of taxes. You do everything you can to avoid the obvious and you hope the taxpayer is already aware of their situation. If they confess, it’s your chance to exhale. What is “filing exempt?” “Filing Exempt” is a term that describes any change in withholding that claims extra exemptions or declares outright exemption for tax withholding. The form that is used for this is called the W4. Most states follow this Federal form but some have their own that works similarly. Travelers file exempt for various reasons. The most common is to bolster take-home pay during a financial hardship. Those periods in life are understandable but there are other reasons travelers file exempt that do not benefit in the long haul, especially when there is an amount is owed with the annual tax return. 1) Extended period of overtime Travelers often confuse tax withholding with actual tax. The statement that someone is “taxed more” for working overtime is misleading. While more taxes may be withheld during an extended period of overtime, the extra withholding is triggered by formulas that anticipate taxes based on a prospective estimate of total annual […]

The post Talking Travel Nurse Taxes: Should I (ever) File Tax Exempt? appeared first on The Gypsy Nurse.

Register Early for the 2014 Navigating Staffing Issues Webinar Series

Lawrence & Memorial Hospital Ends Nurse Lockout

Negotiating committee members and their hospital co-workers waiting for representatives of L&M Corp. to show up for scheduled talks on December 10th.

Hundreds of nurses at Lawrence + Memorial Hospital in New London, Connecticut will return to work Thursday after being locked out for 18 days following a 4-day strike that began on November 27th.

Continue reading

Nurses Again #1 in Honesty, Ethics, 14 of 15 Years in Gallup Poll

Press Release, 12/16/13

In what has become a holiday tradition, nurses are once again viewed as the most trusted profession in the U.S., according to an annual…