What: Department of Public Health – Public Hearings

When: &…

What: Department of Public Health – Public Hearings

When: &…

By: John Nichols

For House Budget Committee chairman Paul Ryan and the Republican Party’s unofficial austerity caucus, the shutdown and debt-ceiling fights did not end in defeat. As part of the deal to end reopen the government and avert a “full-faith-and-credit” crisis, they got an agreement to establish a House and Senate conference committee that is charged with pulling together a bipartisan budget plan.

Ryan makes little secret of his agenda. The Wisconsin Republican is already talking about implementing the “entitlement reforms” he’s been pitching for years. So no one should rule out the prospect that the committee will entertain proposals for the roll-the-dice experiments with Social Security, Medicare and Medicaid voucher schemes, hiking retirement ages, establishing means tests and reducing protections against inflation. At the same time, Ryan would reduce the corporate tax rate and eliminate the alternative minimum tax—completing the “Robin Hood-in-reverse” scenario that so appeals to austerity advocates.

But what are the prospects that the committee will discuss proposals that might attract the resources needed to avoid cuts to essential programs and steer the US economy toward job creation and growth? The Democrats make a bow in the right direction. In addition to investing in job creation, transportation infrastructure and worker training programs, Senate Budget Committee chair Patty Murray, D-Washington, includes proposals to close tax loopholes and eliminate tax breaks for corporations that offshore operations.

But if they are serious about countering austerity—and they should be—Democrats need to offer something more substantial. And the place to begin is with a real alternative to “Robin Hood in reverse.”

As in: a “Robin Hood Tax.”

That’s a tax on high-stakes financial transactions, as proposed in the House by Congressional Progressive Caucus co-chair Keith Ellison, D-Minnesota. Ellison’s “Inclusive Prosperity Tax” would raise hundreds of billions in new revenues. “This is a small tax on Wall Street transactions to meet the needs of our nation,” says Ellison, who asks: “Didn’t America step up to the plate when Wall Street needed help?”

The congressman’s proposal would also reduce harmful market speculation. As Ellison says, “Gambling on Wall Street does not benefit our society.”

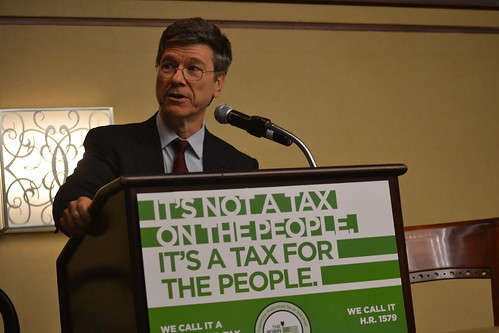

This week in Washington, National Nurses United and 160 groups associated with the Robin Hood Tax Campaign are raising the issue in Washington. A Tuesday teach-in, featuring University of Massachusetts–Amherst economist Robert Pollin, former Texas Agriculture Commissioner Jim Hightower and labor leaders such as Amalgamated Transit Union president Larry Hanley, heard NNU co-president Jean Ross, RN, declare: “The nurses of America have a message for Wall Street: You have the money we need to heal America.” A Wednesday march, congressional briefing ( featuring economist Jeffrey Sachs and European parliamentarian Anni Podimata) and lobbying day will tell members of the US House and Senate that: “It’s not a Tax on the People. It’s a Tax for the People.”

And it’s about time.

This is a vital intervention in a debate that needs a fresh idea.

“With the latest Congressional super committee on budget deliberations about to meet in the aftermath of the brinkmanship over federal funding, a change in tone is needed in Washington,”says Karen Higgins, RN, an NNU co-president. “We are calling on Congress and the White House to refocus on a human needs budget, not just an endless cycle of more austerity and more cuts. We need the Robin Hood tax.”

Arguing for a Financial Transactions Tax does not only have the potential to shift the character of the budget conference committee deliberations. It could move the broader debate beyond the empty wrangling that pits Ryan’s austerity agenda against the austerity-lite response of too many Democrats.

“It’s far past time that we break this cycle and fund America. There is a simple solution: more revenue,” explains National People’s Action executive director George Goehl. “If the government had more money we could break the crisis fever that is killing our economic recovery and devastating most those who can afford it least.”

Goehl and NPA are making the case that a Robin Hood Tax could break the austerity cycle with “a tax of half of a percent or less on big Wall Street transactions [that] would not affect the retirement accounts for middle class and working families. The Robin Hood Tax could generate up to $350 billion each year for investments in America—health care, fighting HIV/AIDS, jobs, safety net, fighting climate change, and affordable housing.”

As NPA says: “It’s a small change for the banks, big change for us.”

That big change will be needed if the conference committee is to reach a budget agreement that rejects austerity in favor of the balance of fiscal responsibility and social responsibility that Americans have every right to demand.

Greg Kaufmann asks whether congress will maintain essential services for seniors.

###

With Congress about to begin the next cycle of budget battles – mostly focused on how much more pain to inflict on Main Street communities across America – a far different message is bubbling up across the land.

Activists from across the land gathered in Washington October 29 to step up what has become an increasingly vocal demand for a change of priorities and tone – with a call to expand the revenue pie with a tax on Wall Street speculation, the Robin Hood tax.

“The fire in this room will light up the sky for a lot of people,” said Larry Hanley, international president of the Amalgamated Transit Union surveying the room in the closing session of an action conference for the Robin Hood Tax campaign.

For the past two years, a movement has been building in the U.S., now endorsed by more than 160 local and national organizations who are calling for a sharp turn away from policies of austerity and more budget cuts with a financial transaction tax on stocks, bonds, derivatives and other financial instruments, paid by those very same banks, investment houses, hedge fund managers, and Wall Street traders who created the latest financial crisis.

RHT Action Conf 2013: Larry Hanley

Or as Hanley put it, “There’s been a 40 year crime wave and we’ve been the victims.”

Much of the impetus of the campaign for the Wall Street tax has come from National Nurses United, the nation’s largest organization of nurses, who have sponsored marches and rallies for the Robin Hood movement and were among the major organizers of the latest conference. “Nurses come with the perspective of humanists who don’t give up on patients,” said NNU Executive Director RoseAnn DeMoro.

RoseAnn DeMoro, right, with NNU co-president Deborah Burger

“Nurses see the fallout of the wretched economic policy in the U.S. and globally and see people who have run out of solutions. We see a community responding to our message, who understand what matters is what pressure we put on” the policy makers, said DeMoro, and the demand “for allocation of funding of programs that make up a society, not the priorities that the corporations set.”

As the conference opened Jennifer Flynn, managing director of Health GAP, discussed what the Robin Hood tax, as embodied in a U.S. bill, HR 1579, sponsored by Rep. Keith Ellison of Minnesota, could mean.

Jennifer Flynn

“With $6 billion a year, we can end the AIDS pandemic within the next 30 years. “With $50 billion we can create the largest job program ever. With less than $3 billion we can end homelessness. With less than $10 billion we can reverse many of the effects of climate change. With less than $100 billion we can provide healthcare for all in most parts of the world. With $60 billion we can transform our education system. That would still leave more than $200 billion for other needs that would be raised by HR 1579.”

Bobby Tolbert

The Robin Hood tax, said Bobby Tolbert of Vocal New York, “is a way to bring power back to the 99 percent. The Robin Hood tax is inevitable, it’s just a matter of time.”

“We have a revenue crisis, and we know where the money is, it’s on Wall Street,” said George Goehl, executive director of National People’s Action. “We’re going to ask the politicians are you going to stand with Wall Street or Main Street?”

Conference delegates

The conference itself was a prelude to a briefing for Congress with leaders of the coalition, renown economist Jeffrey Sachs, and the vice president of the European Parliament Anni Podimata, who will describe how 11 European nations are successfully implementing a similar tax. The briefing is to be held October 31, after which the activists intend to fan out on Capitol Hill to press legislators from 26 states to support the bill.

The activists will also unveil a new letter signed by 163 well known economists and financial experts, including former Labor Secretary Robert Reich, Gar Alperovitz of the University of Maryland College Park, and Thomas Palley of the Economic Policy Institute supporting HR 1579.

One of those economists, Robert Pollin, economics professor at the University of Massachusetts-Amherst, explained to the conference that “the basic idea is a tax on every financial transaction, the equivalent of a sales tax. Who pays the tax? The people who make trades every day on Wall Street.”

Robert Pollin

“With the financial transaction tax we can raise the revenue we need and discourage excessive speculation on Wall Street. It’s being done in the world’s second largest financial market, London and the fastest growing security markets in the world, including China, Hong Kong, Singapore and Russia. If they can do it, so can we,” Pollin said.

Jeffrey Sachs

Sachs, also addressing the conference, cited polls showing 60 to 70 percent of Americans favor higher taxes on the wealthy, and “making the banks pay for what they did” in crashing the economy. Sachs, who is campaigning for the Global Fund to Fight AIDS, Tuberculosis and Malaria noted that $5 billion invested in that effort “would save millions of lives,” and we know “where to find it.”

The 40 top hedge fund managers “took in $16.7 billion in pay last year, and the top tax rate they pay is just 15 percent.” That’s one target group for the Robin Hood tax, he noted. “We need these people to pay their fair share of taxes and their fair share of jail time,” Sachs said.

Erich Pica, president of Friends of the Earth, cited a series of alarming signs of the ravages of the climate crisis, such as 180 communities in Alaska sinking into the water. “Climate change is affecting the air we breathe, the food we eat, the places we live, that’s why Friends of the Earth wants the Robin Hood tax.”

Amirah Sequeira of the Student AIDS campaign noted that “this tax could mean eliminating the crushing student debt we’re currently facing.”

Jim Hightower

“It’s our job to put the Wall Street tax at the center of American politics,” said former Texas Agriculture Commissioner Jim Hightower. “Those who say it can’t be done should not interrupt those who are doing it.”

DeMoro called the tax a “non-reformist reform,” which Pollin noted would establish “a whole new way” of determining economic policy. “It’s not just Wall Street who will decide if we have revenue for a green economy or education. We can’t just let Wall Street make all those decisions.”

“It’s up to us, DeMoro concluded, “to build a movement that changes society.”

###

GLOUCESTER, Mass. − The ten registered school nurses who care for Gloucester’s 3,000-plus public school children, and who are represented by the Mas…

Great things are happening in the Travel Nursing Community. In an effort to promote travel nurse socialization and support, The Gypsy Nurse Ambassador Program was born. As a part of the Gypsy Nurse Ambassador Program, we have organized events happening all over the country. The Gypsy Nurse Ambassadors work hard to bring you exciting and fun events as frequently as possible. In addition to meeting other Gypsy Nurses and having a Great time, you can earn your Gypsy Bracelet and Charm by attending an Ambassador sponsored event! Vermont Gypsy Oktoberfest WINDSOR, VT This event was organized by your Gypsy Ambassador Cheryl We all met up at the Oktoberfest, We had some Delicious food and a German beer or two, We listened to music and chatted about our positions, families etc. We had 11 ppl and 2 dogs in Attendance. Was a great time! Your Ambassadors Want to know what the Gypsy Nurse Ambassadors are planning? Check the Calendar for upcoming events near you!! If you have an Ambassador in your area, get in touch with them and suggest an event!

The post Vermont Gypsy Oktoberfest appeared first on The Gypsy Nurse.

How do some travel nurses live out of their motor homes/campers? I think this would be efficient but I don’t see how it is feasible. Not every hospital is going to be within reasonable driving distance from an RV site. I appreciate any advice. Thanks!

Ask a Travel Nurse Answer:

The RV approach certainly is possible. However, it does take some extra planning and initial expense. But, if you are only traveling by yourself, it could be a lot easier. I like my one bedroom apartments while on assignment, but if it were me and I chose to travel by RV, I would buy a full size truck and a truck camper (the type that sits in the back bed of the truck). Some nice used truck campers can be had for under $10K. Even if you bought a REALLY nice, brand new truck, and opted for a new camper, you should still come in below $40K (much less than a full size RV would set you back). Plus, with these type campers, you drop it at the campground, pull out from under it, and drive to your job in just the truck. To drive a full size RV to work every day is not feasible and it would be more than I would ever want to deal with in trying to haul another car behind a full size RV.

While there are not campgrounds around every corner, there are certainly enough to find one relatively close to just about any assignment out there. Honestly, if I had my twenties to do over again, I would give very serious consideration to traveling like that.

Best of luck!